This is the second post in my series. This time I considered weather and housing prices.

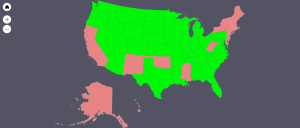

I’ve decided most of the Northeast is just incompatible with me. The weather involves too much snow, and while climate change is warming everything West of the Rockies, the entire east coast is seeing new record lows.

HPI was very useful, home ownership is a must for me, so if I move somewhere I am deciding to invest in the state. Which state had the best returns on real estate? Colorado, led HPI on the 1 year time scale and 24 year time scale. Pretty amazing sustained growth. Maryland and NJ ranked dead last on 1 year HPI change, no surprise. HPI is perhaps the best way to judge a state, if people are moving there because it is a good state with lots of opportunity, you see state to state immigration increase, which causes property values to rise.

Delaware and New Mexico are out, their 5 year HPI change is ~1%, it doesn’t even keep up with inflation. New Mexico is also very poor as I noted before, the weather is not ideal. Delaware doesn’t have a lot of industry, and while finding a tax free beach town to chill at sounds appealing, there isn’t many job opportunities.

1960-1990 government data. Wish I could have found something more recent.

Vermont and Rhode Island are out for poor HPI performance, and the weather. Maine and New Hampshire are out only for the weather. Their finances are not good either, and they’ve been low on most of the lists I’ve considered.

West Virginia has the highest unemployment rate, more than 2% over national average, it’s a poor state that relies on a collapsing coal extraction industry. Beautiful state though.

Oklahoma is out, the tornado density is a real problem if you’re thinking long term. Only Texas and California have declared more major disasters than OK, and they are massive states. Florida is very high on the natural disaster index as well, but I’ve done the hurricane thing enough to know it’s nothing like a tornado. OK keeps building stick houses too, FL actually makes a lot of concrete ones.

Took a look at energy prices. I’ve already eliminated most of the bottom 10 states with the most expensive prices, except Wyoming and North Dakota. I’m going to wait until I look at more general cost of living before I use this data. Both states did very well on financials.

I really want to eliminate some states because of the low temperatures and wind chill, but that puts North Dakota on the chopping block. ND is the only state with a publicly owned central bank, they lead the country in job creation, and the fastest growing GDP. I can’t do it.

Texas, Colorado and Florida seem to all be very well positioned to make the top 10. The next post will start to get more and more subjective, I’ve eliminated a lot of states and now I can look at more specific information like wages, housing, etc.